Our Credit Alliance levels the playing field with crowdsourced data.

Real-time data from multiple sources gives you the most accurate snapshot of customer credit worthiness.

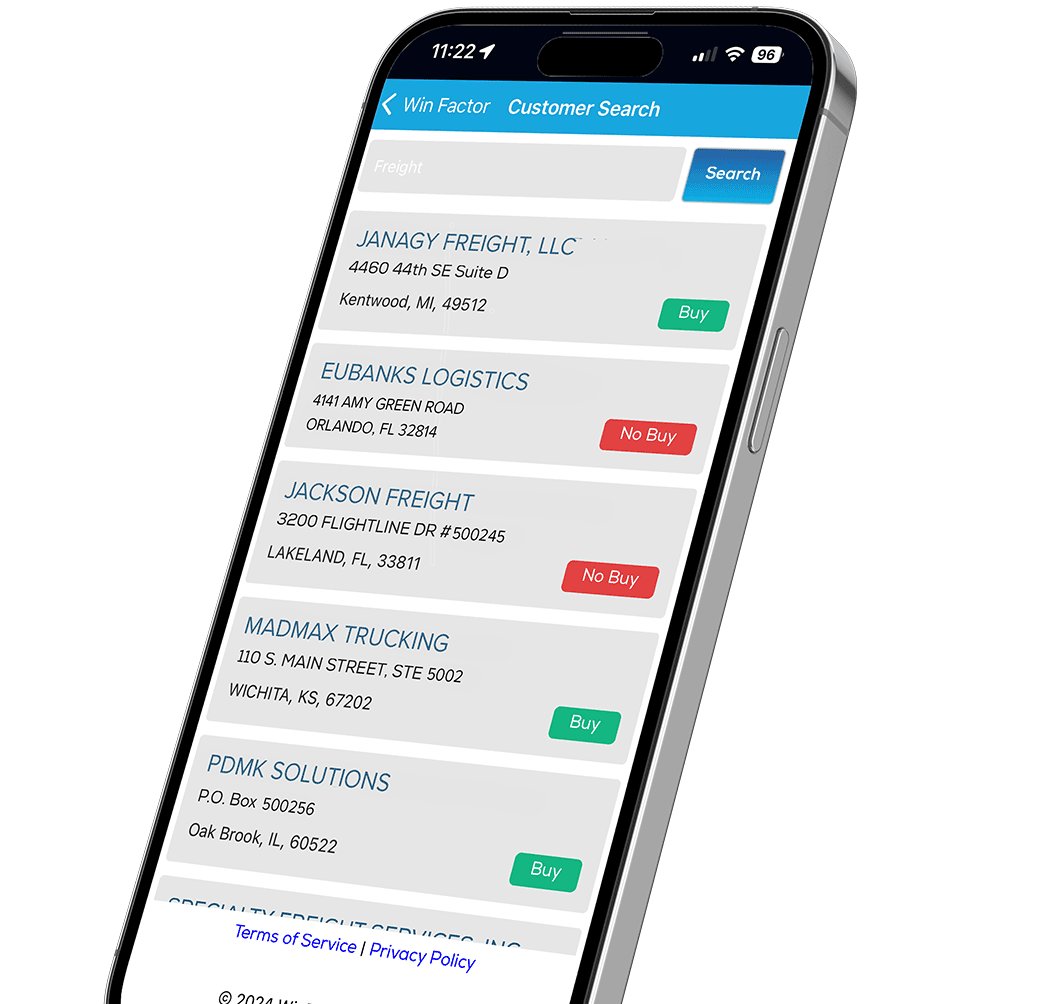

Software Factoring Platform with Integrated Credit and Fraud System

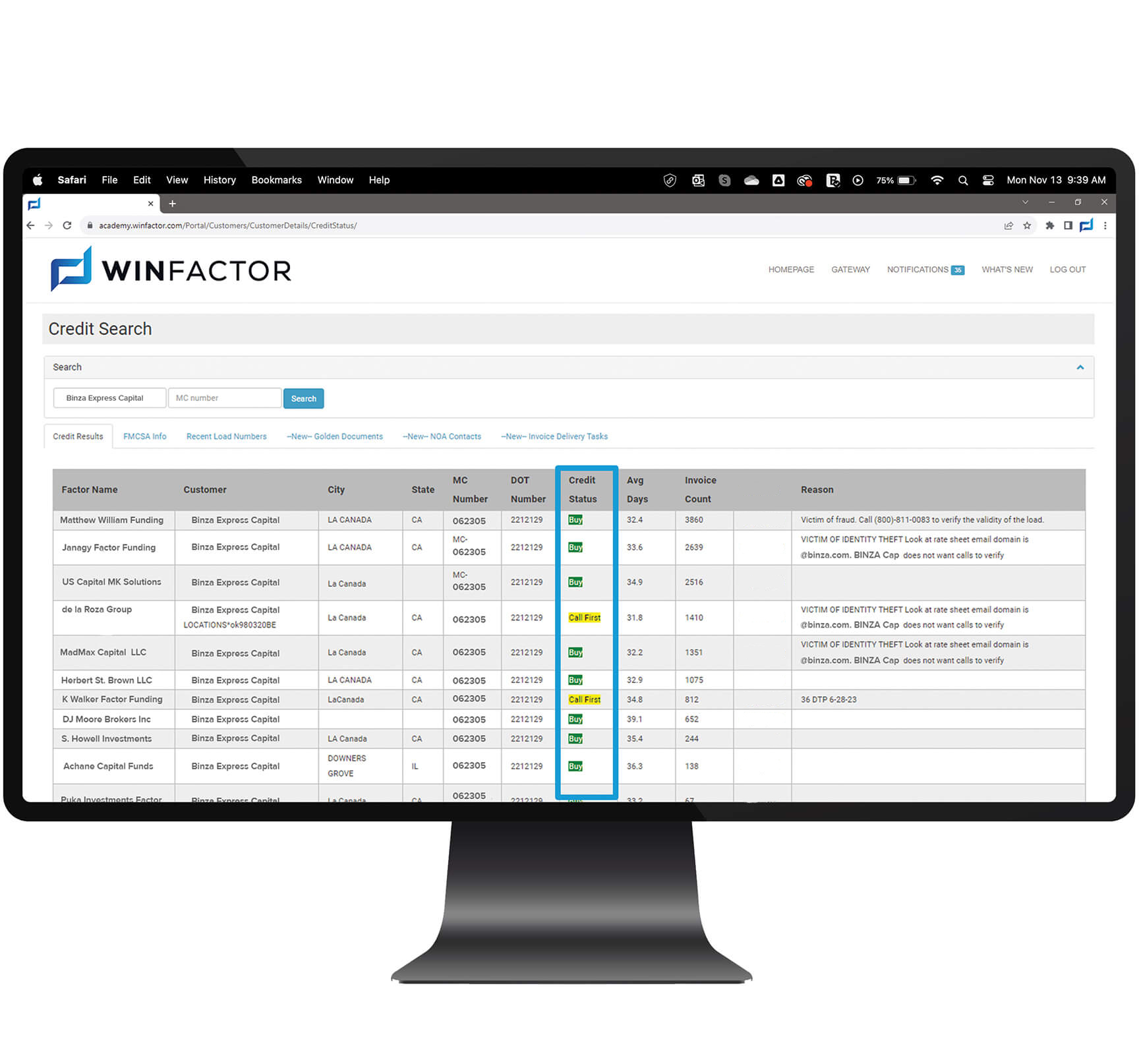

Buy, No Buy, Call First

Leverage data from your fellow factors to make informed decisions. WinFactor™ gives you more smart data than any other software factoring platform so that you can factor with confidence.

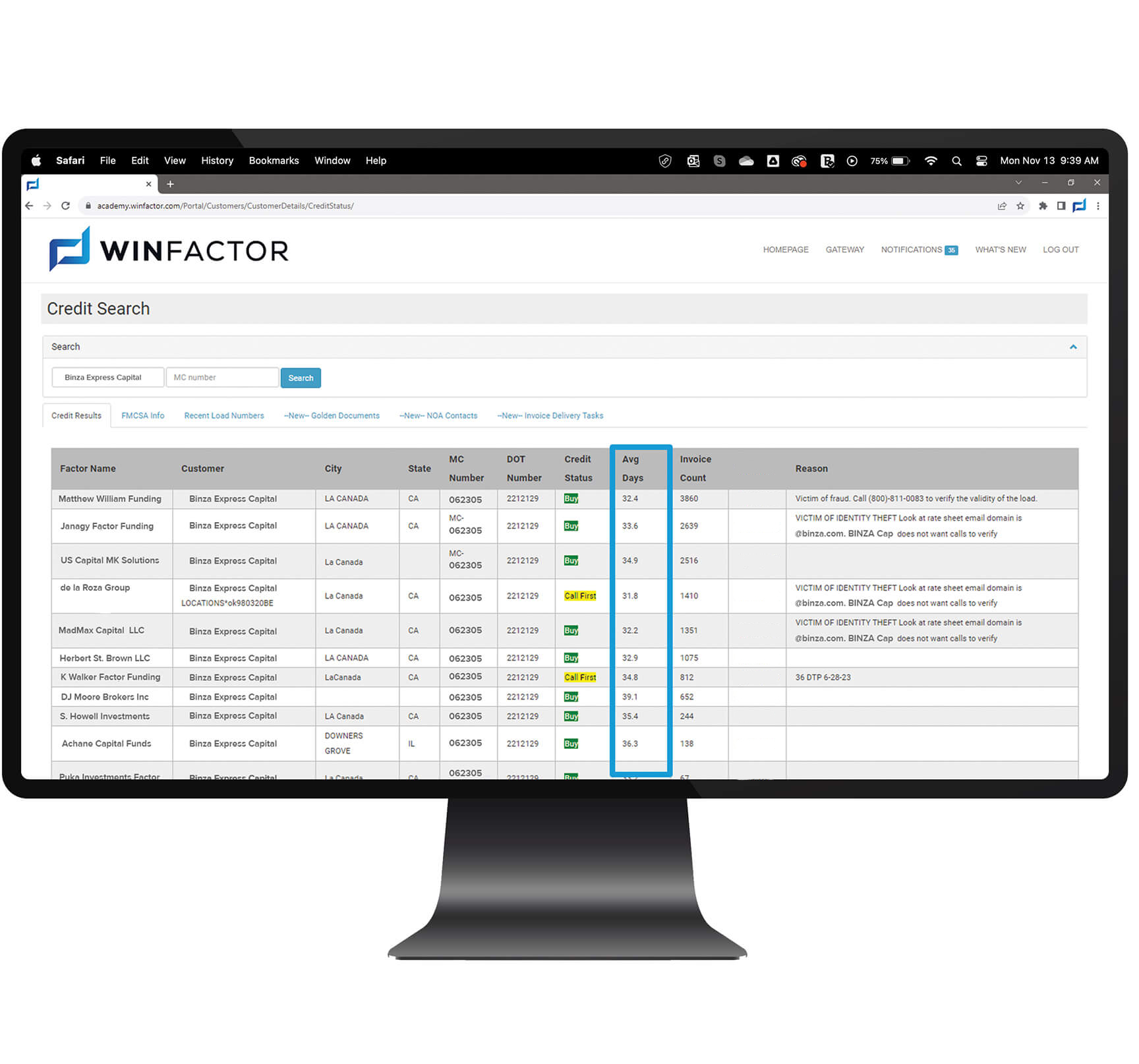

Average days to pay

Average days to pay shown in the integrated credit system is the most up-to-date data in the market. See the average amount of time your debtors are taking to pay, down to the decimal point. WinFactor’s Credit Alliance is a powerful tool to help you succeed.

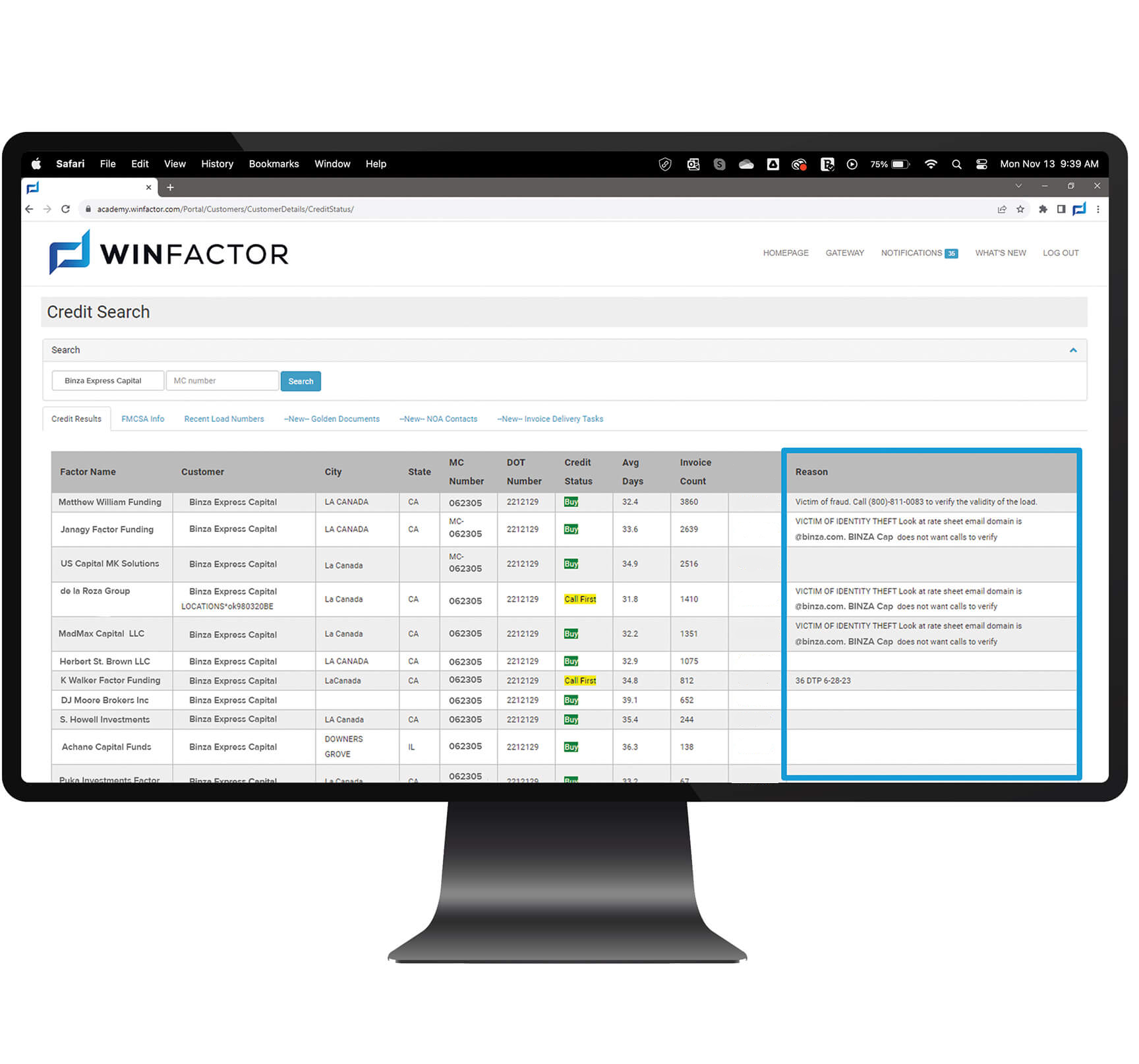

Notes and Reasons for Credit Rating

WinFactor’s Credit alliance provides you powerful crowdsourced data from your peers. See detailed information on why your clients have received the credit rating they have been given. Our nightly feed from the Federal Motor Carrier Division combined with the detailed information from other Factors, gives you the most comprehensive tools on the market to make informed funding decisions.

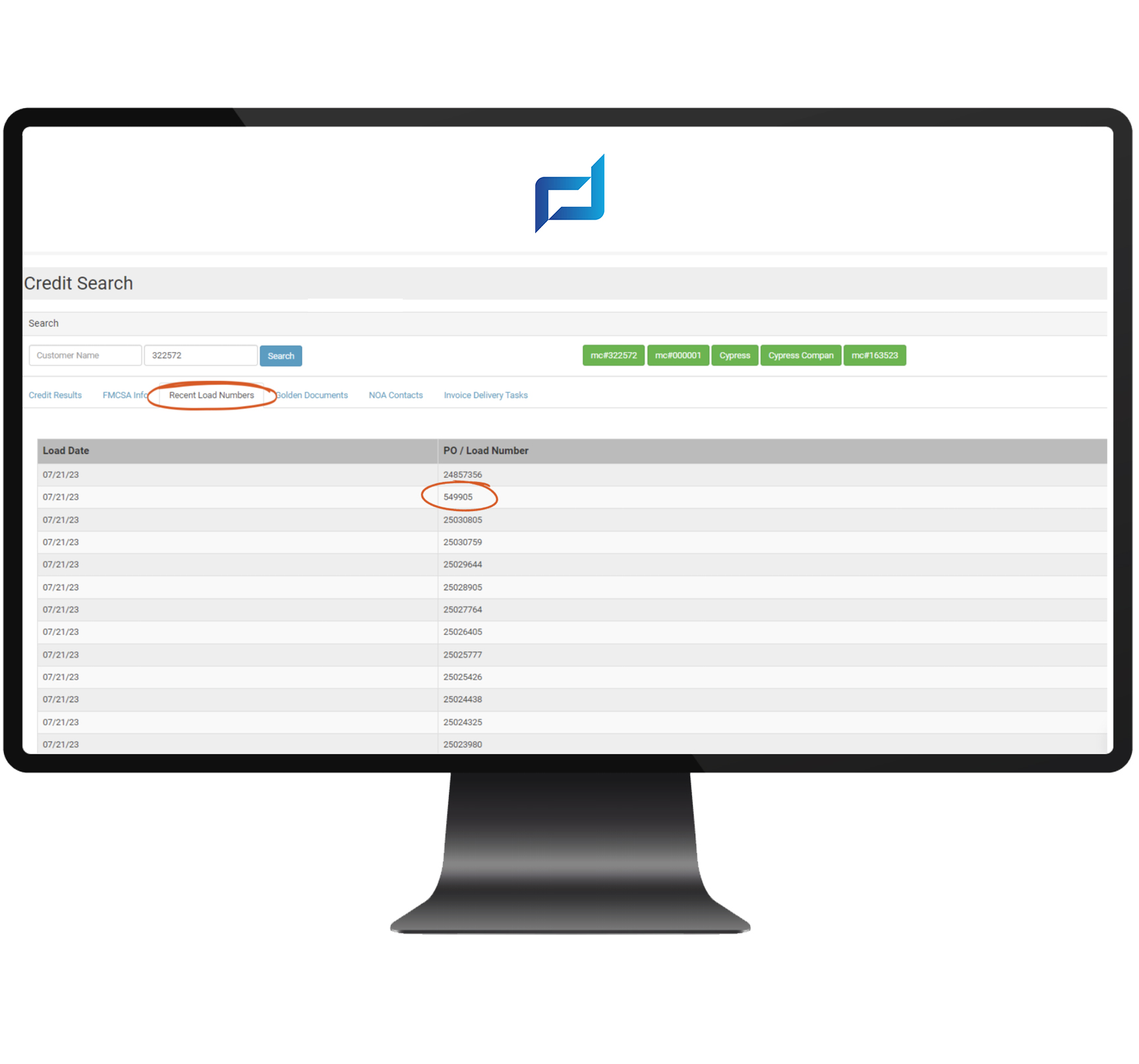

Recent Load Numbers

WinFactor™ provides our factors with the most powerful and comprehensive fraud prevention data on the market. Within our credit system, you can see recent load numbers sequences used by brokers. This will help you spot fraudulent load numbers and validate the rate sheets submitted to you. WinFactor’s Credit Alliance gives you an all-in-one solution for all your factoring software needs.

Schedule a Demo

WinFactor™ has been the leader in this space for years. Our software factoring platform is built specifically for the Transportation Factor. That is why every feature and function is designed to make your workflow easier and faster. Schedule a demo today.